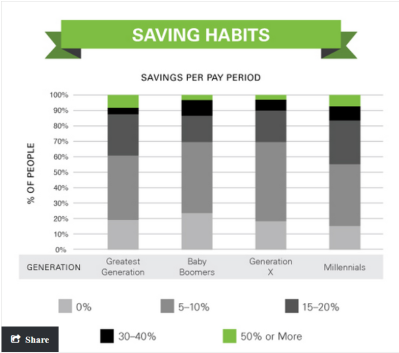

On August 9, 2015 an article was published on marketwatch.com titled: “Millennials are saving — but they’re doing it wrong” the article discussed how the generation that grew up during the crash of September 2008, also known as the Great Recession, are saving at a rate higher than any other generation.

Source: http://www.marketwatch.com/story/millennials-are-saving-but-theyre-doing-it-wrong-2015-08-07

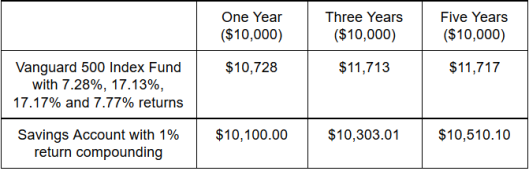

According to a study by bankrate.com and cited by MarketWatch, 26% of Americans under 30 are invested in stocks. The 74% of Americans who are not investing their money and earning a maximum of 1% on their savings accounts are actually losing money when you factor in an average inflation rate of 1.6% in 2014. Meanwhile if invested in the Vanguard 500 Index Fund, which owns the 500 largest companies listed on the US stock exchange, than you would have made a return of 14% in 2014. After fees of 0.17% and inflation of 1.6% you would have earned a profit of 12.33% on your investment instead of losing 0.6% due to inflation on a savings account. An example is:

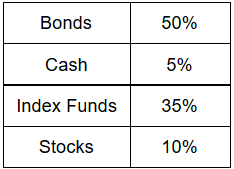

- Asset Allocation

An important point to remember when deciding how to save for retirement or even just save in general is there is no such thing as all or nothing in investing. The term for this is asset allocation and in layman’s terms means how you organize your portfolio. An example is:

As you can see from the allocation above investing is not an all or nothing strategy. Index Funds follow certain parameters for their allocation which can be anything from a sector of the market to the S&P 500. Stocks are individual companies and therefore, less diversified. Bonds are debt and I recommend not owning any bonds with a credit rating less than A- bonds can also be insured which helps limit your total amount of risk. Another important point to consider is why is this money being saved. Your retirement account should have less risk than the rest of your investments and your allocation should reflect that. Remember there is no one size fits all investment strategy and you as an adult need to take the time to create your own personal asset allocation strategy.

As you can see from the allocation above investing is not an all or nothing strategy. Index Funds follow certain parameters for their allocation which can be anything from a sector of the market to the S&P 500. Stocks are individual companies and therefore, less diversified. Bonds are debt and I recommend not owning any bonds with a credit rating less than A- bonds can also be insured which helps limit your total amount of risk. Another important point to consider is why is this money being saved. Your retirement account should have less risk than the rest of your investments and your allocation should reflect that. Remember there is no one size fits all investment strategy and you as an adult need to take the time to create your own personal asset allocation strategy.

- No Time?

What about people who do not have time to research each individual stock? My recommendation is an Index Fund. Index Funds have a great resource, morningstar.com an example of which can be found here. With investing it is important to remember to have a long term outlook. When I invest I look forward ten years into the future and ask myself will I be glad I owned this and why. Vanguard and Fidelity have great low cost Index Funds. When purchasing an Index Fund, unlike a stock, you are purchasing a basket of stocks with a general theme. That theme can be anything from mirroring the S&P 500 to clean water. My personal recommendation is to start out with Vanguard 500 Index, found in the example above, and expand from there.

- Being Uninformed is no Excuse

When I was 12 years old I taught myself to read a quarterly and annual SEC filing. I did it through reading the reports and looking up terms and phrases on sites like Investopedia.com and sometimes Wikipedia.com. I took a half an hour out of my day to read articles on the BBC, CNBC, and Bloomberg. Reading daily news helps you understand the connections of our daily world. My blog provides a daily news breakdown Monday through Friday.

-Websites

-Blogs

- A great blog on personal finance for the rudimentary investor to the expert is How To $tuff Your Pig at howtostuffyourpig.com. You won’t regret paying them a visit.

- The Financier Daily at financierdaily.com check back with us for daily news breakdowns as well as market commentary and analysis.

Reblogged this on How to $tuff Your Pig and commented:

“When I was 12 years old I taught myself to read a quarterly and annual SEC filing. I did it through reading the reports and looking up terms and phrases on sites like Investopedia.com and sometimes Wikipedia.com.” The Financier Daily

I’m impressed! So impressed that I just had to share this post!

LikeLike

Thank you that means a lot! It just takes time and determination.

LikeLiked by 1 person

Russell,

This is a great article. What are your thoughts on etf’s that track a broad based index like the S&P?

LikeLike

Sorry for the late reply. I think ETFs like the Vanguard 500 Index Fund Admiral Shares (VFIAX) are a great, cheap way to track the broad market. ETFs that track index’s like the S&P 500 are an important part of any portfolio.

LikeLike

I’m amazed, I have to admit. Rarely do I encounter a blog that’s both equally educative and entertaining, and without a doubt, you have

hit the nail on the head. The issue is something that not enough people are speaking intelligently about.

Now i’m very happy I stumbled across this in my hunt for

something regarding this.

LikeLiked by 1 person

Thank you for the complement I try to keep things educational yet fun. Unfortunately I have recently become incredibly busy and have not had the time to write any new articles. Hopefully that will change soon.

LikeLike