Tags

There are a number of earnings reports coming out this week and with oil ending today below $45 I decided to discuss the potential impact of the price of oil on some of the companies releasing their Q2 2015 reports.

Recently the price of oil has crashed with a 52-week high of $93.34 to a 52-week low of $43.35; oil has dropped 22.70% in 2015 alone. This has caused some obvious losers like oil and natural gas exploration companies but what about the not so obvious winners? In Q1 2015 the average price of WTI crude was $48.54 this helped companies like Air Canada post record breaking profits.

|

| Statista |

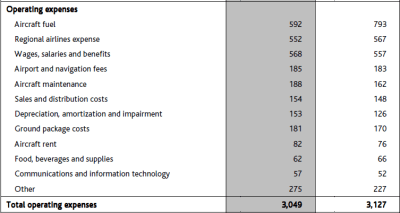

One of the driving forces behind their outstanding quarter was the drop in the price of oil. In Q1 2014 the cost of aircraft fuel was approximately 25% of total operating expenses of CAD$3.127 billion. In Q1 2015 the cost of aircraft fuel was approximately 19% of total operating expenses of CAD$3.049 billion.

|

| Q1 2015 is in gray Q1 2014 is in white (dollar amounts in Canadian Dollars) |

- Industries with high fuel costs

- Airlines

- Waste Management

- Transportation

- Etc.