Tags

ASX, ASX: EDE, ASX:EDE, EDE, Eden, Eden Innovations, Equity, Equity Research, ESG, Finance, News, Research, Research Report, Stocks

Summary

- Eden Innovations (ASX:EDE) has developed a concrete additive that has proven to increase strength and durability drastically without significant cost.

- Eden Innovations has also developed a concrete additive that allows approximately double the fly ash to be used, reducing costs while improving performance.

- After many years of trials, Eden Innovations has a significant pipeline of customers at the end stage of the decision to adopt its concrete additive products.

- Eden Innovations has a portfolio of other promising products, including a proprietary method of producing blue/green hydrogen and carbon nanotubes and a plug-and-play system for converting a diesel motor to natural gas.

Eden Innovations (ASX:EDE) is not a new company, first listing on the Australian Securities Exchange [ASX] in June 2006. The listing was primarily focused on the pyrolysis process, a ‘blue/green’ [I will define this later in the report] method of hydrogen production developed by Eden with the University of Queensland, Australia. Things went right for Eden over the first few years after listing, reaching an all-time high of approximately AU$00.73 on 1 May 2007. But several significant setbacks, largely out of management’s control, have seen the stock drop to record lows.

- Primary Listed Exchange: ASX:EDE

- Price on ASX [27 February 2024]: AU$00.002

- Market Capitalisation on ASX [27 February 2024]: AU$7,350,000

- Average Shares Traded Last Three Months on ASX [27 February 2024]: 2,516,219

Today, the company has pivoted and now has a diversified portfolio of five products: EdenCrete® and EdenCrete Pz®, OptiBlend®, the Pyrolysis Project, Hythane™, and EdenPlast®.

The report will be structured as follows:

- Concrete the Future Needs

- EdenCrete®

- EdenCrete Pz®

- The More Fly Ash We Use, the Cleaner our World Becomes

- EdenCrete Pz® Increases the Amount of Fly Ash Utilised

- Green Concrete at a Lower Cost Than Ever Before

- Helping the Transition Away From Diesel

- OptiBlend®

- The Pyrolysis Project: Manufacturing Carbon Nanotubes and Hydrogen on the Cheap

- Blue and Green Hydrogen, What’s the Difference?

- Licensing and Joint Ventures are the Focus

- Other Intellectual Property

- Hythane™

- EdenPlast®

- It’s Now or Never

- The Next Three Months

- Management is as Invested as Possible

- Expect to be Diluted

- Eden is a Binary Investment Opportunity

- My Position

- August 2023 Capital Raise

- Disclaimer

Concrete the Future Needs

Before we go further, it’s important to clarify that Eden isn’t involved in the concrete or cement production business. Eden produces an additive designed to improve the strength, durability, and use of fly ash/slag in the concrete mix while reducing costs. The company sells the additive and doesn’t manufacture any form of concrete for sale. Why is this important? The margins in the concrete manufacturing business are horrible, and it’s highly competitive.

The cement industry.. needs at least a 15% gross profit margin… An analysis of publicly listed cement mills suggests the gross profit margin of the companies drastically dropped to 8%-9% in the October-December quarter of 2021, from around 15% a year ago.

Business Standard

Fortunately, this is where Eden comes in with its two products: EdenCrete® and EdenCrete Pz®.

EdenCrete®

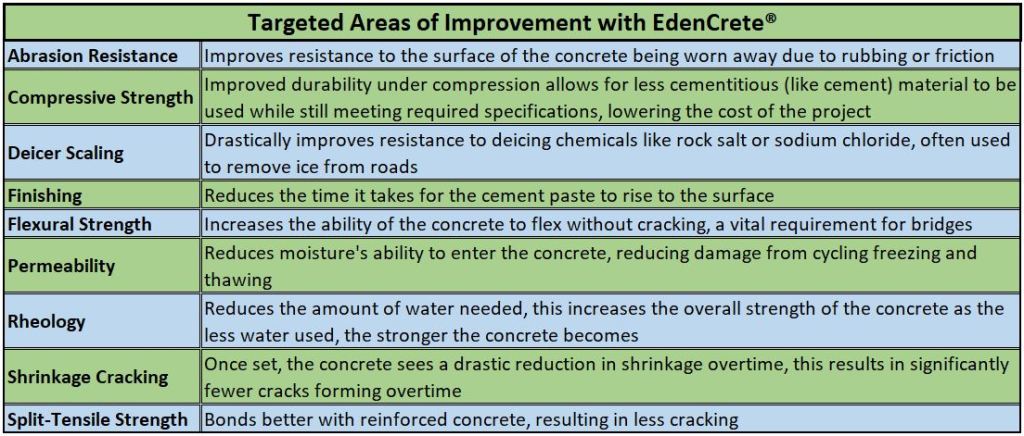

EdenCrete® is a concrete additive designed to improve the mixture’s strength and durability by utilising carbon nanotubes. The nanotubes greatly strengthen the bonds between the cement paste and the aggregate. EdenCrete® provides the following targeted benefits:

EdenCrete® is primarily for use in Portland cement mixes, but what really caught my attention was their claim the U.S. Georgia Department of Transportation required its use in all concrete slab replacements. If true, this is strong evidence of Eden’s significant performance and cost claims.

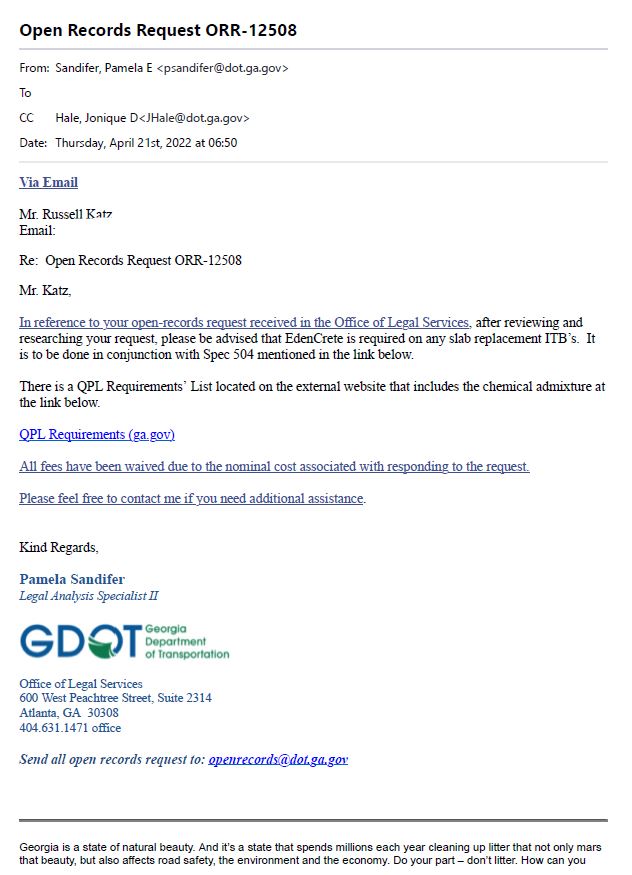

Accordingly, I filed an Open Records Request with the U.S. Georgia Department of Transportation and received the below correspondence, verifying Eden’s claims.

Unfortunately, this requirement by the U.S. state of Georgia hasn’t led to the revenue one might expect. As of 2015, 95% of roads in Georgia were asphalt, not concrete, despite plenty of evidence that concrete offers better life cycle cost analysis [LCCA] results. The Georgia Public Policy Foundation summed up the state legislative’s attitude as:

Ask government about asphalt’s dominance and you’ll get the answer, “Because that’s the way we’ve always done it.”

Fortunately, Eden has recognised the problem and shifted tactics in 2019 to achieve adoption of EdenCrete® in Georgia through bridges, a significant portion of which are concrete across the whole U.S.

The trial, initiated in November 2019, added two gallons of EdenCrete® per cubic yard of concrete. Initial results were decisive:

- After 24 Hours – Compressive strength – 2767 PSI (12% over design)

- After 72 Hours – Compressive strength – 4790 PSI (37% over design)

- After 28 Days – Compressive strength – 6787 PSI (70% over design)

- After 28 Days – Flexural strength – 915 PSI (41% over design)

After two and half years in service, EdenCrete® saw strong results compared to the control:

- 37.5% reduction in chloride concentration at 14.5 mm depth

- 50% reduction in chloride concentration at 18 mm depth

Following these excellent results, Eden stated:

A meeting with GDOT is presently being arranged to review these results, and Eden is optimistic that this may lead to GDOT deciding to use EdenCrete® in appropriate bridge projects.

Unfortunately, bureaucracy is a slow-moving machine, and we are still waiting for a decision from the U.S. Georgia Department of Transportation. But I believe there is reason to be hopeful for similar results as the requirements around concrete slab replacement I referenced above.

During the second quarter of FY24, Eden sold 3,355 gallons of EdenCrete® for the U.S. Georgia Department of Transportation projects, generating US$84,081 [~AU$125,602] in sales. This comes to US$25.06 per gallon of EdenCrete®. While this is far from ‘relevant’ sales compared to Eden’s costs, it’s worth noting that in the first month of 2024, Eden received and filled an order for 2,200 gallons of EdenCrete® for US$62,700 [US$28.5 per gallon].

EdenCrete Pz®

EdenCrete Pz® is a newer variant of EdenCrete, with the first sale occurring in 2019. While offering many of the same benefits, EdenCrete Pz® is designed for use with pozzolanic cement mixes. For those unfamiliar with pozzolanic materials, don’t worry; I had to Google it myself when I first researched Eden.

Pozzolanas, or simply ‘pozzolans’, may be defined as ‘materials which, though not cementitious in themselves, contain constituents which will combine with lime at ordinary temperatures in the presence of water to form stable insoluble compounds possessing cementing properties’.

Lea’s Chemistry of Cement and Concrete (Fourth Edition), 1998

Pozzolanic materials include volcanic ash, pumice, opaline shales, burnt clay, and fly ash. For EdenCrete Pz®, the relevant material is fly ash and, to a lesser extent, slag.

The More Fly Ash We Use, the Cleaner our World Becomes

Fly ash is one of the most common by-products of burning coal, mostly made of silica. According to the U.S. Environmental Protection Agency [EPA], coal ash is one of the most extensive types of industrial waste. Approximately 130 million tons of coal ash was generated in the U.S. during 2014.

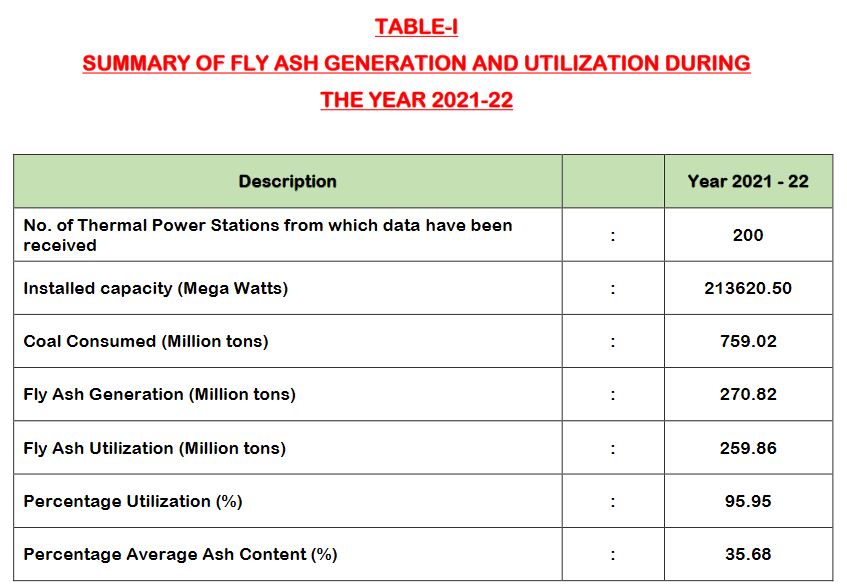

As one of the world’s top utilisers of coal power generators, India is also one of the largest fly ash producers. According to India’s Ministry of Power’s Report on Fly Ash Generation at Coal/Lignite Based Thermal Power Stations and its Utilization in the Country for the Year 2021 – 22 [published August 2022], 95.95% of fly ash produced was utilised, as shown the below table:

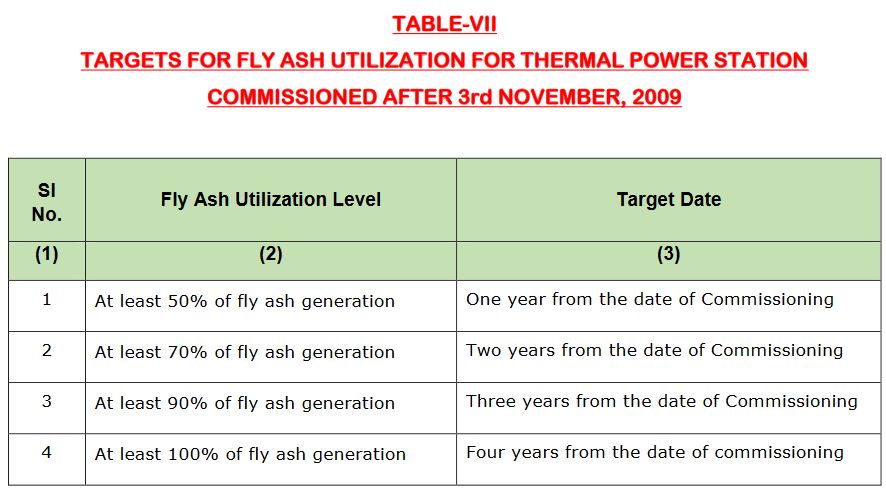

While 95.95% might seem like a fantastic utilisation rate, that leaves at least 10,960,000 tons of fly ash, which is still being dumped into ponds. This is a major problem for the Indian government, which took action in 2009 as the Indian Ministry of Environment, Forests requiring fly ash utilisation to reach 100% by the fourth year in operation of any thermal power station built after November 3, 2009:

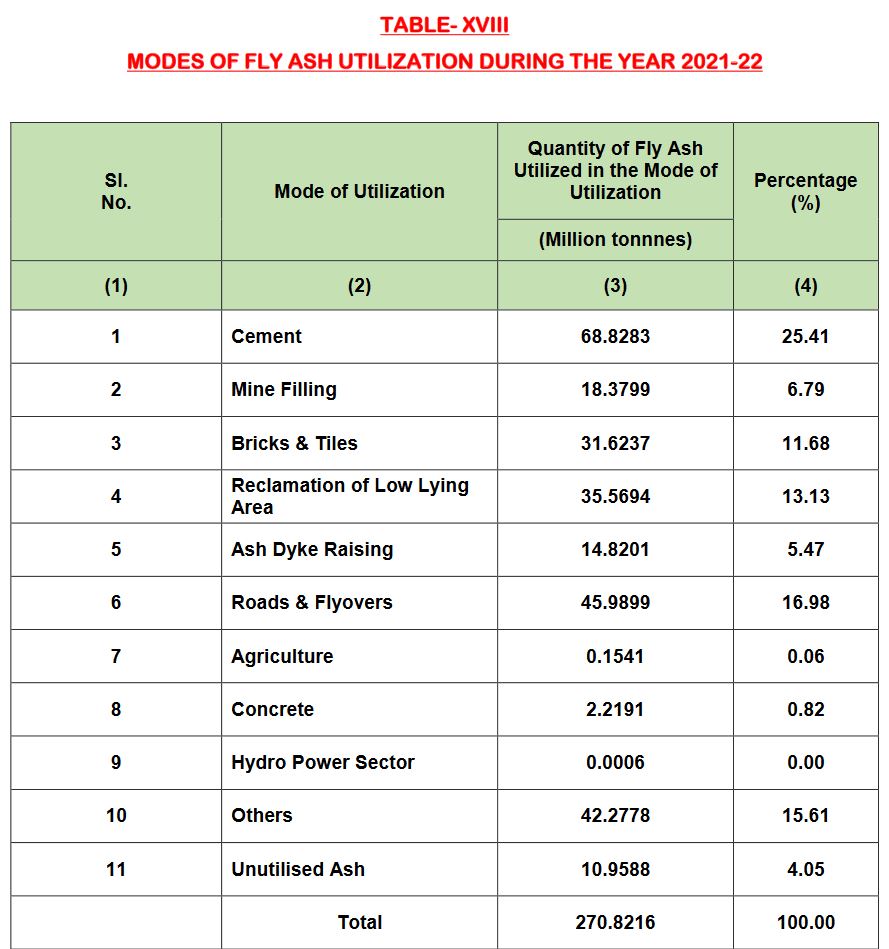

The primary source of fly ash utilisation by almost 1,000 basis points is pozzolanic cement mixes as shown in the below table:

It should be noted that there are reports which indicate the situation is far worse than the Indian government is reporting. In 2021, the Centre for Science and Environment said 50% of Indian thermal power plants failed to meet the government’s 100% fly ash utilisation mandate. In fact, the report found “many plants fail to utilize even 30-40% of the ash they generate”. An even greater problem, according to the report, is the 1,650,000,000 tons of ‘legacy’ fly ash stored by the industry.

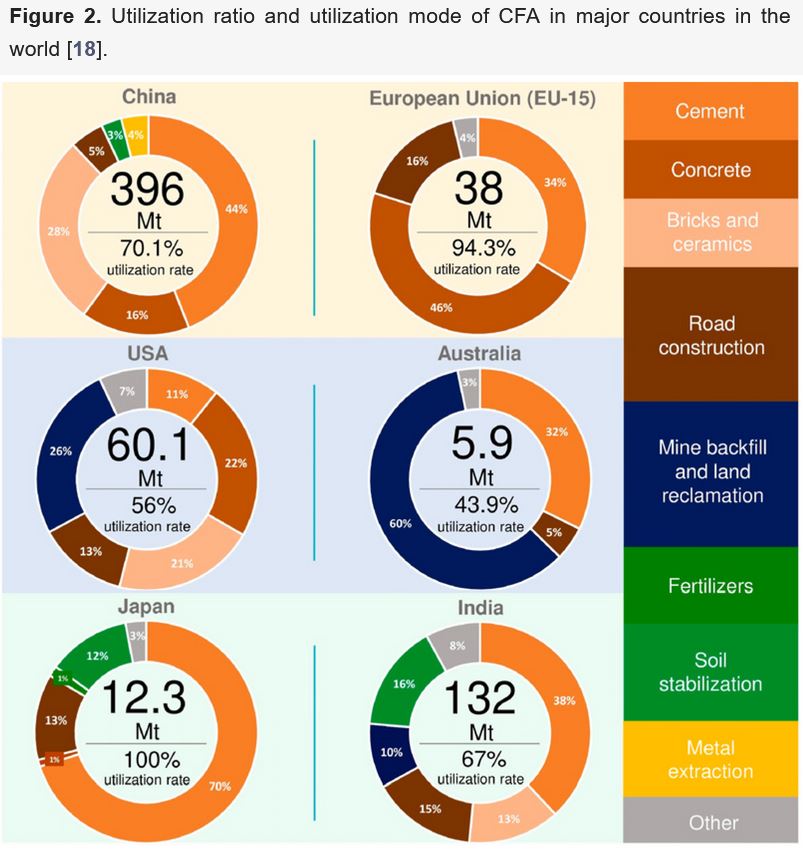

India isn’t the only country with an overabundance of fly ash; in many ways, China is grappling with an even worse situation as the world’s largest consumer of coal for energy [56.2% of total Chinese energy production during 2022]. While I won’t go into as much detail as I did with India, the main statistics are as follows:

- As of 2017, China produced approximately 600,000,000 tons of fly ash per year

- Approximately 200,000,000 tones are stored instead of utilised

- China’s stockpile of fly ash is likely approximately 3,000,000,000 tons, although due to the opaque nature of the country it’s difficult to tell. The only thing that’s certain is it’s rising at a rapid rate

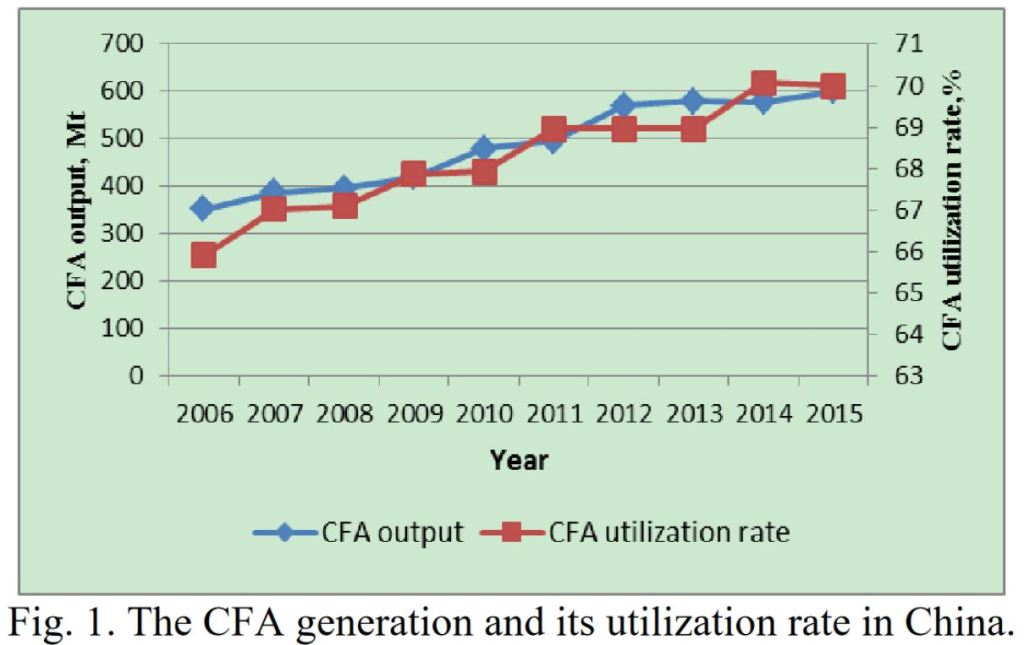

Like India, China is making an effort to increase its fly ash utilisation rates, with slow and steady success, increasing from 66% to 70% in 2015:

As of 2022, fly ash use in cement was 44% of fly ash utilisation. While I don’t have more recent hard numbers, the amount used in cement is a key part of China’s strategy to utilise its fly ash.

For more information on China’s fly ash production and stockpile, I found Challenges and Developments in the Utilization of Fly Ash in China by Shu-Hua Ma, Min-Di Xu, Ququge, Xiao-Hui Wang, and Xiao Zhou as well as Recycling of Coal Fly Ash in Building Materials: A Review by Lu, Xuhang, Bo Liu, Qian Zhang, Quan Wen, Shuying Wang, Kui Xiao, and Shengen Zhang to be informative.

The numbers are clear, the world has a fly ash problem, and cement is one of the primary ways we can solve this problem.

EdenCrete Pz® Increases the Amount of Fly Ash Utilised

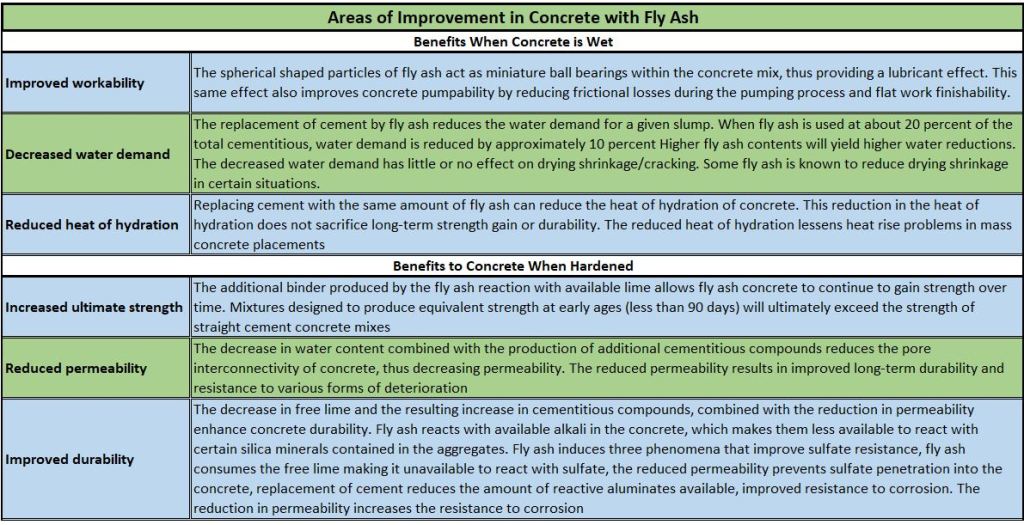

Adding fly ash to concrete is well known to generate significant benefits, according to the U.S. Department of Transportation’s Federal Highway Administration:

The U.S. Department of Transportation’s Federal Highway Administration also reports fly ash typically replaces between 15% to 30% of Portland cement when used, with ratios of fly ash to Portland cement replacement is usually 1:1 to 1.5:1.

The question remains, if fly ash is so much better than Portland cement, then why don’t we replace it completely? Greenspec provides a concise explanation:

(Fly ash) can’t be used completely as a substitute for cement because it relies on the water and lime from the cement to hydrate as part of the overall chemical reaction.

This is where EdenCrete Pz® comes in, both improving the performance of concrete pozzolan mixes and increasing the amount of Portland cement, which can be replaced with fly ash, to an incredible 60%.

In a presentation released to the ASX on 8 September 2023, Eden summarised EdenCrete Pz® as a:

cost effective, carbon nanotube enriched liquid admixture that is mixed into any wet concrete (including high pozzolan mixes (fly ash and slag) that:

– Allows replacement of <60% of cement with low-cost fly ash (coal fired power station waste) producing low cost, high strength, low CO2 concrete- Reduces CO2 footprint by~90% of mass of cement replaced – 100kg cement replaced = ~90kgs CO2 saved

Green Concrete at a Lower Cost Than Ever Before

Both EdenCrete® and EdenCrete Pz® offer green credentials, although EdenCrete®’s ‘green’ is due to the tangential benefits rather than clear outcomes like EdenCrete Pz®.

The ability of EdenCrete® to produce a significantly stronger and longer-lasting product could arguably result in fewer resources needed in the long term, following a reduction in repair and replacement costs.

EdenCrete Pz®, on the other hand, allows for approximately a 100% increase in fly ash used in cement mixes at the low end and approximately a 300% increase on the high end. As I hinted above, fly ash is an incredibly toxic material in its raw form [it’s not a danger when used in cement mixes].

But don’t take my word for it; an article published in the Ecotoxicology and Environmental Safety journal, volume 269 and published 1 January 2024 titled, A comprehensive review of the toxicity of coal fly ash and its leachate in the ecosystem said:

Coal fly ash [CFA], a byproduct of coal combustion, is a hazardous industrial solid waste. Its excessive global production, coupled with improper disposal practices, insufficient utilization and limited awareness of its inherent hazards, poses a significant threat to both ecological environment and human health.

By allowing for such a high degree of Portland cement to be replaced with fly ash, the CO2 produced in a cement mix is reduced by approximately 90%, according to Eden:

Reduces CO2 footprint by ~90% of mass of cement replaced – 100kg cement replaced = ~ 90 kgs CO2 saved

While the significant green nature of cement mix utilising EdenCrete Pz® is clear, that’s not enough of an argument for use with many companies. As I hinted above, fly ash is exceptionally cheap compared to cement mix. So, the more fly ash a mix can use, the higher the margin the concrete becomes, and as I said at the beginning of this report, concrete is a low-margin business. This makes the cost of using EdenCrete Pz® negligible in the worst case.

Helping the Transition Away From Diesel

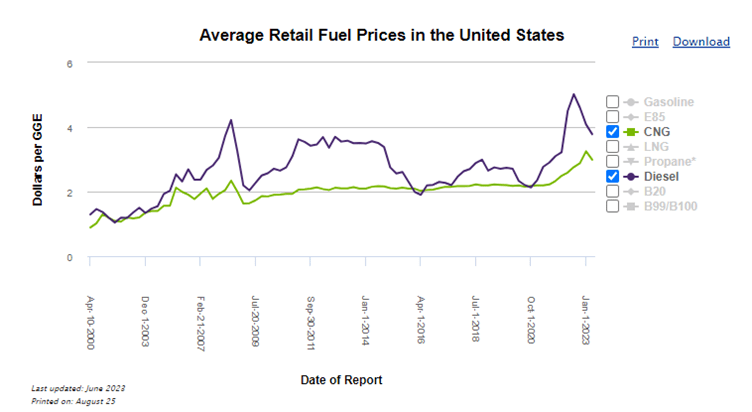

Diesel engines are on the chopping block in many parts of the world for a litany of reasons. While the price of diesel versus natural gas differs depending on the country or even the state or province, a report by Cummins on the Total Cost of Using Natural Gas Engines released the following comparison chart:

As you can see, the cost of diesel is on average, significantly higher than CNG in the U.S. Cummins reports:

Between April 1 and April 15, 2023, the national average price of diesel fuel in the United States was $4.25 per gallon. The national average price of compressed natural gas [CNG] in that same timeframe was $2.99 per diesel gallon equivalent [DGE]. This difference in price would save a fleet $12,600 each year by running on CNG over 10,000 DGE of compressed natural gas.

From a government perspective, the emissions and air pollution produced are the primary concern; from a commercial perspective, the regulator risk and significantly lower cost options combine to make a compelling case to switch.

OptiBlend®

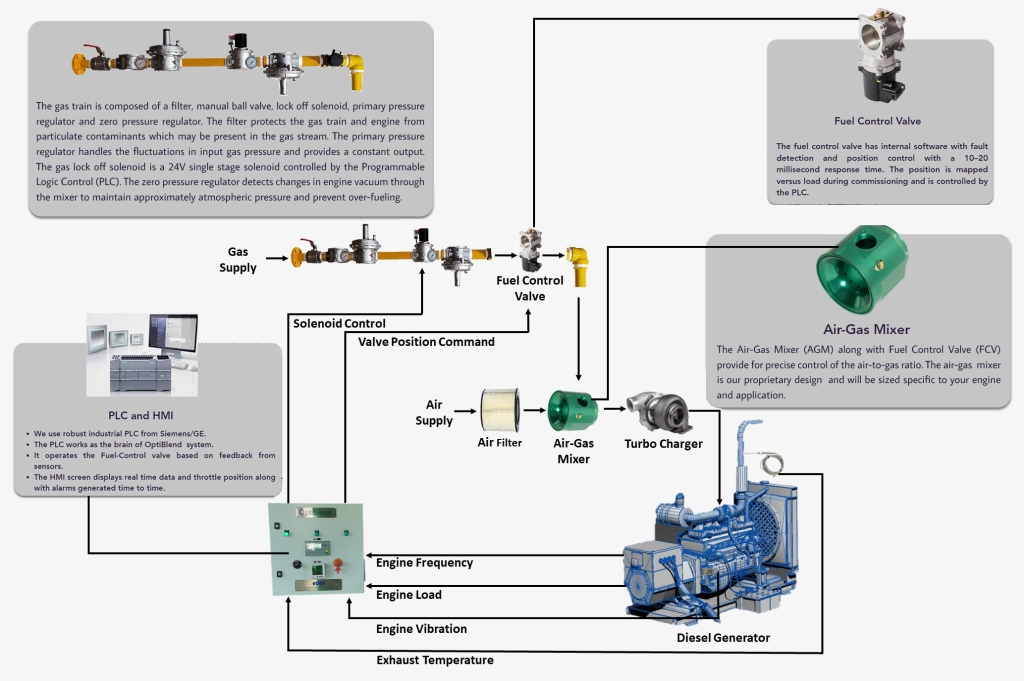

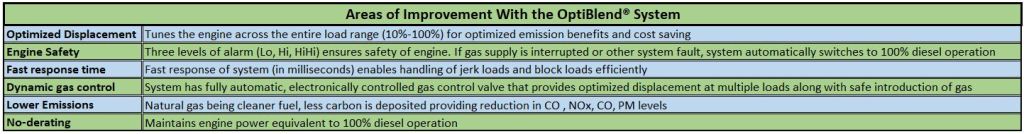

OptiBlend® is a ‘plug-and-play’ system that converts a conventional diesel engine to run with natural gas, the primary fuel. I classify OptiBlend® as a ‘plug-and-play’ system because it doesn’t require “modifying the engine or the current diesel fuel system.”

Eden has create a handy guide on the components of OptiBlend® system:

The system provides a number of benefits aside from cheaper fuel, as shown in the chart below:

The primary market for OptiBlend® has historically been India due to government restrictions, regulations, and concerns around potential future vehicle regulations. For example, the Indian Ministry of Petroleum and Natural Gas announced a proposal to ban diesel passenger vehicles in cities by 2027 in early 2023. While it’s worth noting this is unlikely to happen, the government does regularly [multiple times a year] place temporary bans on diesel vehicles entering cities due to air pollution reaching hazardous levels.

The OptiBlend® system is not the cheapest option sold in India for conversion, but it’s consistently ranked as one of the top-performing options.

Still, vehicles aren’t the only target market. Any system that utilises a diesel engine is a target. For example, in 2014 Cummins selected the OptiBlend® system for retrofitting dual-fueled power on oil drilling rigs. Eden has recently redoubled its efforts to expand sales in the U.S., focused on generator conversion. However, the results have been disappointing so far.

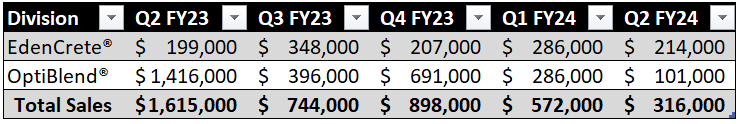

While I will go over the financials in more detail later on, it’s worth noting the Eden India division, which is made up mainly of OptiBlend® sales, is the only profitable division in the company.

The Pyrolysis Project: Manufacturing Carbon Nanotubes and Hydrogen on the Cheap

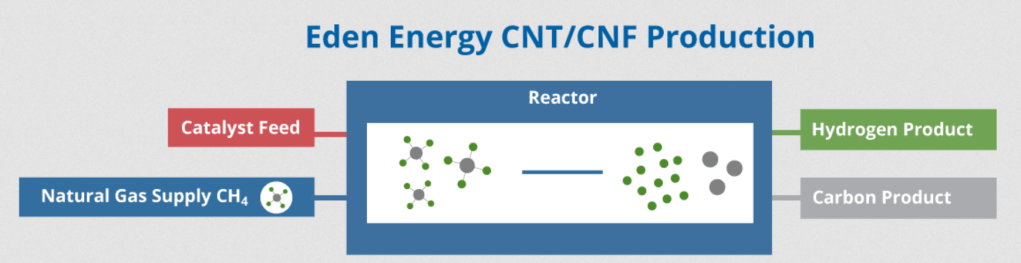

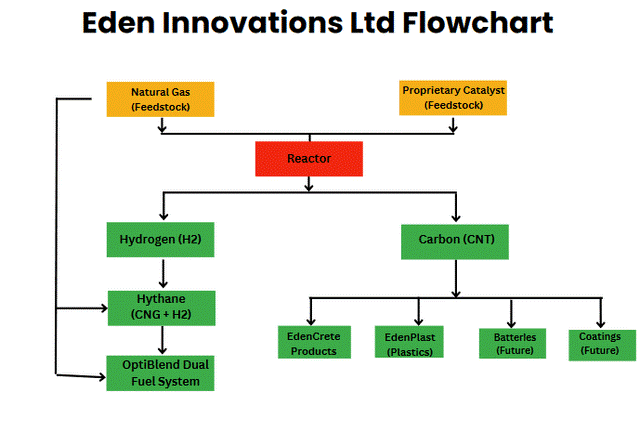

The Pyrolysis Project was the original innovation Eden used to IPO back in June 2006. The process has two requirements, natural gas and a catalyst. Unlike similar methods, the catalyst feed uses no precious metals, utilising low cost catalysts.

The mass produced by the Pyrolysis method is split with 25% hydrogen and 75% carbon nanotubes. It’s important to remember that while hydrogen is sexy, the carbon nanotubes are a significantly more valuable commodity, with a tensile strength between 100 and 300x that of steel at only approximately 17% the weight while maintaining strong thermal and electric conductive properties. In fact, a core component of EdenCrete® is carbon nanotubes.

Blue and Green Hydrogen, What’s the Difference?

There are two types of environmentally friendly hydrogen: blue and green. It’s worth noting while the definitions I’m using below are what I believe are moving to be the consensus, it’s still controversial.

Blue hydrogen is produced by separating the hydrogen content from fossil fuels like biogas, natural gas, and coal. Usually, blue hydrogen is called ‘blue’ because the carbon dioxide produced through this process is prevented from being released through carbon capture technology or by converting the carbon dioxide into a product without any dispersal.

Green hydrogen is produced through the utilisation of an electrolyser, splitting water into hydrogen and oxygen. In this process, the electrolyser is powered using renewable energy generation, like solar or wind. I believe green hydrogen is bound to become the cheapest form of hydrogen production eventually, but this requires a large supply of renewable energy. In the meantime, blue hydrogen is likely to make a significant impact.

Licensing and Joint Ventures are the Focus

While the technology has taken a back seat in recent years, it still offers significant potential for licensing revenue and the creation for joint ventures without Eden needing to supply cash. The joint venture possibility was solidified on February 21, 2024 when Eden announced a conditional agreement with Venture Aerospace LLC, a private U.S. company founded by former NASA scientists.

The goal of the joint venture with Ventrue Aerospace is to:

Develop, market, and potentially manufacture, solid-state batteries that are anticipated to offer, including through incorporating Eden’s carbon nanotubes: ultra-high performance; higher energy density; lower resistance; low cost, using widely available, recyclable materials; lower heat during operation and a reduced fire risk; and suitability for use in a wide range of applications.

The initial split of the joint venture will see Eden control 30%, and Venture Aerospace 70%. This split is due to three reasons:

- The design of the batteries will be based on existing intellectual property by Venture Aerospace. All relevant intellectual property will be transferred to the joint venture

- Eden will provide the carbon nanotubes to the joint venture on commercial terms, and will keep the Pyrolysis intellectual property

- Venture Aerospace will be responsible for raising US$10,000,000 in working capital for the joint venture within the next three months.

- This will result in a new ownership structure with the investors controlling 20% interest, Eden 24% interest, and Venture Aerospace 56%

While this joint venture is an exciting opportunity, and doesn’t increase Eden’s cash burn rate, it doesn’t close the door on licensing opportunities for the Pyrolysis Project. For example, we are still waiting to hear if an undisclosed major oil and gas explorer will license the technology following significant testing of the carbon nanotubes produced last year. However, the results from Venture Aerospace’s due diligence are an encouraging proof of concept.

Other Intellectual Property

In my view, EdenCrete® and EdenCrete Pz® are the most exciting parts of Eden, followed by OptiBlend® and the Pyrolysis Project. But Eden has two other promising technologies in its portfolio which have the potential for expansion in the future or provide additional licensing opportunities.

Hythane™

Hythane™ is a premium blend of natural gas containing approximately between 5% and 7% hydrogen. The technology was wholly acquired by Eden in 2004 and added as a transition fuel by the Indian Government in 2006. In 2009, Eden won a tender to build the first Hythane™ station for Indian Oil.

Unfortunately, we haven’t heard anything on the subject since 2009, and I don’t expect Hythane™ to return to Eden’s radar anytime soon. However, the technology isn’t completely dead, in 2021 India’s Minister for Petroleum & Natural Gas and Steel announced an expansion in the use of Hythane™ beyond the bus bus pilot project in New Delhi to other major cities. Still, programs like this move at a glacial pace in India, and the technology has several detractors.

Therefore, I consider Eden’s Hythane™ technology as an interesting, dormant part of Eden’s portfolio. It can potentially be a future revenue driver, but don’t hold your breath. With that said, I would be interested to see if the company could sell the technology, but I don’t have any information that this has or hasn’t been considered by management.

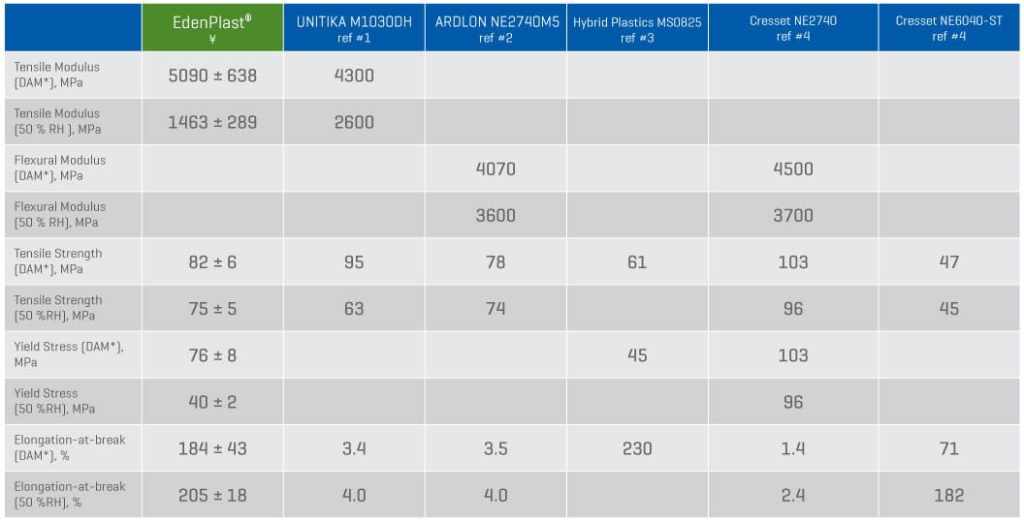

EdenPlast®

EdenPlast® was developed jointly by Eden and the University of Queensland, Australia as part of collaborative research project into combining carbon nanotubes into plastics. The initial results were rather impressive, as shown in the below table:

EdenPlast® completed a trial with an unnamed Japanese company, but there hasn’t been any success in finding an initial commercial customer so far. However, I don’t read too much into this lack of success. Eden has a severe cash flow problem, and the limited resources mean management has been forced to shelve the development of this technology for the time being.

Of the two products I’ve classified as ‘Other Intellectual Property’, I believe EdenPlast® to have the greatest potential. However, due to the extremely early stage of commercialisation, I don’t believe I will hear about this product for at least a few years. This is due to management’s focus rightfully remaining on righting the ship through continued adoption of EdenCrete® and EdenCrete Pz®, OptiBlend®, and sourcing licensing opportunities for the Pyrolysis Project.

It’s Now or Never

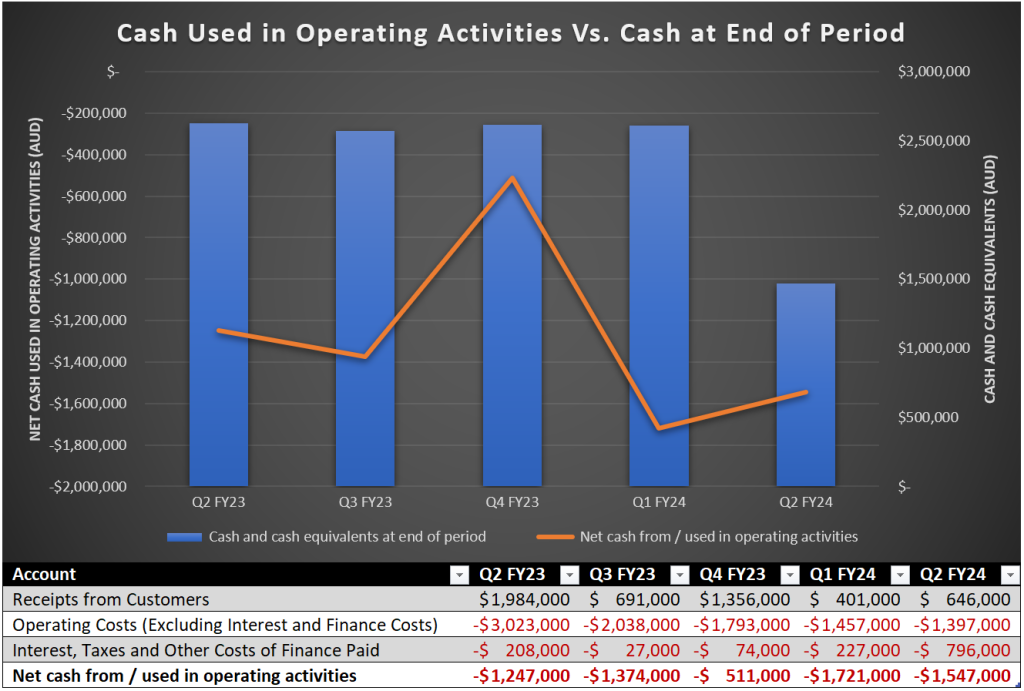

There’s no other way to put it: Eden is at a critical moment with its cash balance, and bankruptcy is a real risk. As shown in the chart and table below, the company’s cash balance has consistently been right on the line of its quarterly burn rate over the last five quarters.

The sharp swings in receipts from customers is due to a decrease in sales from OptiBlend® following a delay Indian legislation surrounding air quality standards for dual fuel systems. The delay lasted until 31 December 2023, which means its likely to be a temporary issue. When Eden’s Q3 FY24’s quarterly report is released, I will be paying close attention to see if sales has recovered in India as planned.

The Next Three Months

One of the key reasons I decided to size up in Eden at the last placement was the large number of trials and tests for EdenCrete® and EdenCrete Pz®, which I believed at least some of them were likely to come through over the next 12 months. The timeline is less than eight months by the latest quarterly report [31 December 2023]. I have summarised a number of the most significant trials and new potential markets below:

U.S.:

- Rehabilitation of irrigation pipelines [California]

- Modesto Irrigation District and Innovative Shotlining Inc are evaluating EdenCrete® for use in a spray-on thin concrete membrane. The purpose of the membrane would be the rehabilitation of underground pipelines for irrigation districts, public utilities, and agricultural companies in California.

- The results of trials are expected in February 2024. If the trial comes back with positive news, this would open a new market for EdenCrete®.

- A successful outcome in this trial would also likely help with discussions Eden has been having with the U.S. Federal Bureau of Reclamation.

- Eden hopes the Bureau of Reclamation will trial EdenCrete Pz® products for strength in the coming months.

- Modesto Irrigation District and Innovative Shotlining Inc are evaluating EdenCrete® for use in a spray-on thin concrete membrane. The purpose of the membrane would be the rehabilitation of underground pipelines for irrigation districts, public utilities, and agricultural companies in California.

- Kansas Department of Transportation

- Permeability testing of EdenCrete® and EdenCrete Pz® by McPherson Concrete Products is in process.

- The trial is a follow-on from a successful result with the McPherson Concrete Products, City of McPherson, and the U.S. Department of Housing and Urban Development during 2023.

- The final results are expected before June 2024. If succesful, there’s the potential for EdenCrete® being approved for use in future Kansas Department of Transportation bridge deck projects. Eden reports there are a number scheduled during the U.S. summer of 2024.

- Permeability testing of EdenCrete® and EdenCrete Pz® by McPherson Concrete Products is in process.

- New Mexico

- Federal Environmental Protection Authority Project

- Thorcon Shotcrete and Shoring, a U.S. shotcrete contractor whose used EdenCrete® for five years, has submitted a proposal for capping a radioactive tailings pile with shotcrete containing EdenCrete®.

- If Thorcon wins the project, this would open a new project market for EdenCrete®

- Thorcon Shotcrete and Shoring, a U.S. shotcrete contractor whose used EdenCrete® for five years, has submitted a proposal for capping a radioactive tailings pile with shotcrete containing EdenCrete®.

- Federal Environmental Protection Authority Project

- Colorado

- United Airlines (NASDAQ:UAL) – Denver International Airport

- Met with the Maximum Civil Construction to review work completed over the last few years for United Airlines.

- The results were promising with all installed patch work overlays and full depth panel replacements reporting strong performance.

- 3,000 cubic yards of concrete work are currently in the pipeline for U.S. Spring 2024. Eden report “EdenCrete® will be dosed at 1 gallon /cubic yard.”

- The results were promising with all installed patch work overlays and full depth panel replacements reporting strong performance.

- Met with the Maximum Civil Construction to review work completed over the last few years for United Airlines.

- United Airlines (NASDAQ:UAL) – Denver International Airport

India:

- The Indian market is focused on EdenCrete Pz® due to the need to utilise fly ash.

- “Several” trials with new customers took placed during Q2 FY24, although none have yield a sale so far. However, these trials are often long processes.

Indonesia:

- Eden supplied a quote to a major Indonesian ready-mix producer for EdenCrete Pz® products.

- The quote was requested by the company following the successful completion of trials.

Other countries:

- A major, multi-national cement and concrete [unnamed] company has been trialing EdenCrete® and EdenCrete Pz® products across four unnamed countries, in North America, South America and Europe.

- These trials have been in the works for over 12-months.

- The trials started with laboratory tests, followed by field trials.

- Initial results have been consistent with all other trials, or in other words, encouraging.

- This trial is likely one of the ‘holy grail’ contracts for Eden, but the company notes “The time these trials take is considerable, but at this stage they are looking encouraging.”

- Initial results have been consistent with all other trials, or in other words, encouraging.

- The trials started with laboratory tests, followed by field trials.

- These trials have been in the works for over 12-months.

Management is as Invested as Possible

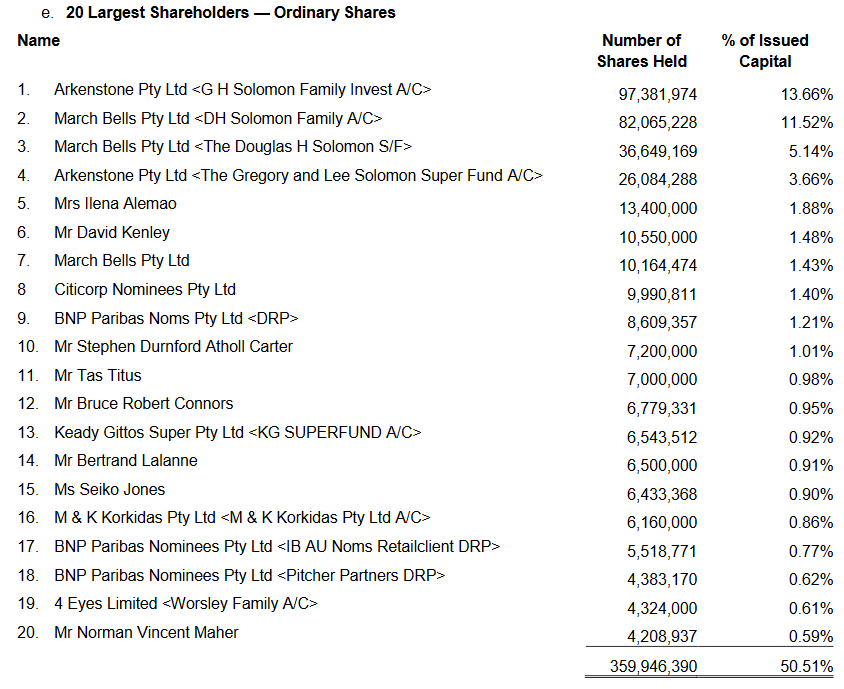

In many ways, Eden’s continued ability to fund operations has been due to management’s willingness to use their outside interests to provide additional funding through loans and direct investment. In this case, when I say management, I am specifically referring to Gregory Solomon [Executive Chairman] and Douglas Solomon [Non-Executive Director]. Yes, they are brothers.

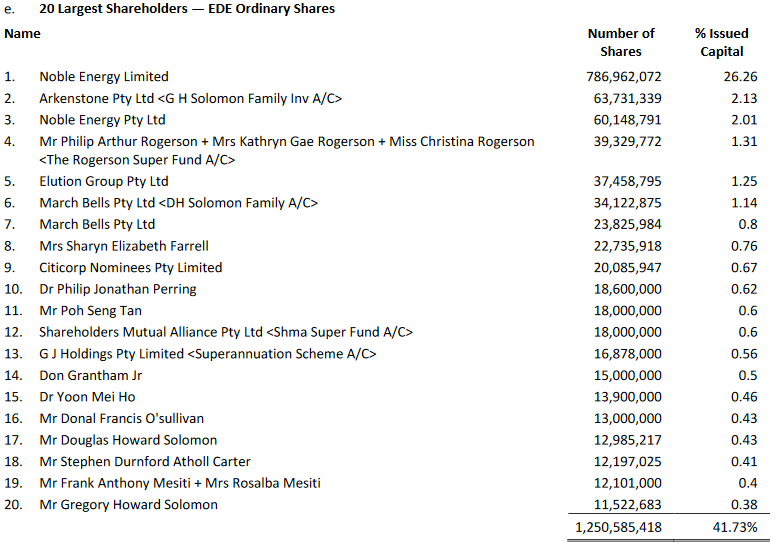

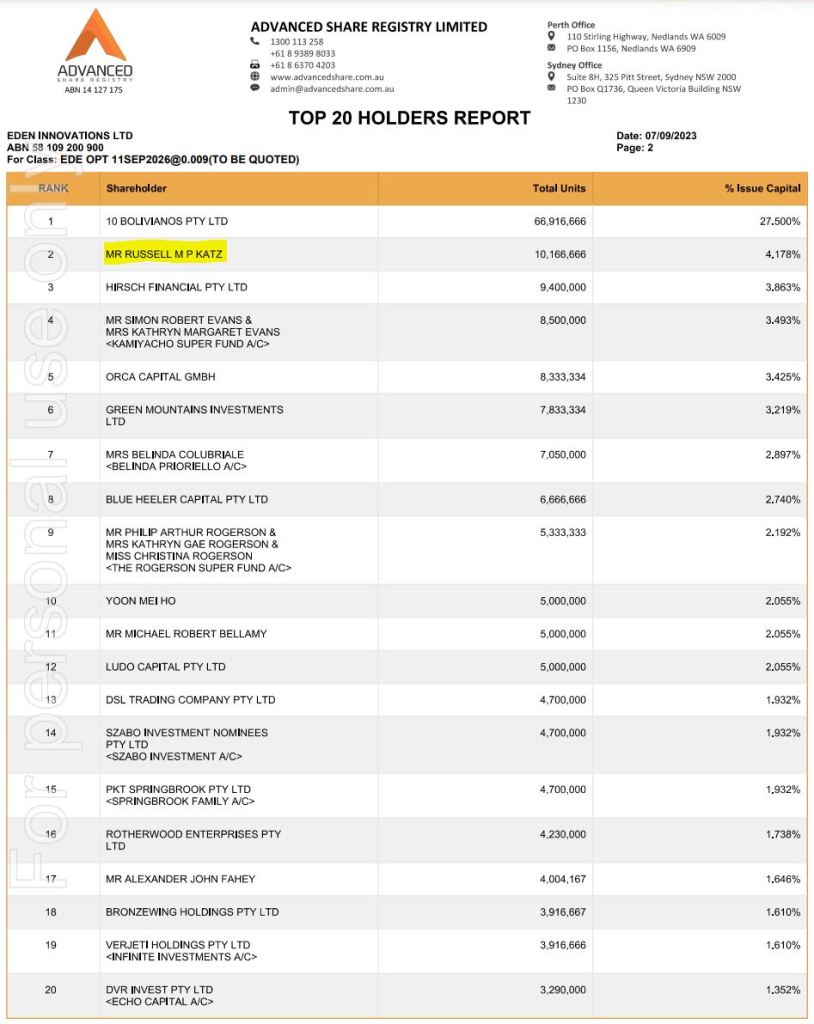

Before I continue, please be advised that I only have access to the the 20 largest shareholders list as of 30 June 2023, published in Eden’s last annual report. While the Solomon family’s holdings are split across a number of accounts, their total ownership is well in excess of 30%.

I have arrived at the 30% mark by accounting for the Solomon family’s effective control over Noble Energy Limited, a wholly owned subsidiary of another ASX listed company, Tasman Resources (ASX:TAS) as shown in the below table:

Gregory Solomon is also the Executive Chairman of Tasman Resources, and Douglas Solomon is a Non-Executive Director.

While I do accept if I wanted to arrive at the Solomon family’s exact ownership stake in Eden I would have to account for their partial ownership in Tasman Resources, I haven’t for two reasons:

- I don’t have easy access to a full shareholder list for either company

- For the purposes of my point, I don’t believe it’s necessary

I have spoken directly with Gregory Solomon on several occasions, and my takeaway from our conversations was the Solomon family believes completely in Eden’s vision, and will continue to provide funding for as long as they possibly can.

The Solomon family’s commitment to Eden was further proven on 12 February 2024, when Nobel Energy increased its loans to Eden by an additional AU$450,000. This brings the total loan to approximately AU$3,000,000 after rounding, including accrued interest. The loan is unsecured and at an interest rate of 9.97% per annum. Historically, parts of this loan were converted to shares in Eden, and there is an agreement in place to convert AU$320,000 of this loan to shares after 1 June 2024.

While the loan’s interest rate of 9.97% per annum might initially generate some sticker shock, the rate is extremely generous as it’s unsecured, and I would argue that a fair classification of Eden’s debt would be ‘junk.’ The Reserve Bank of Australia‘s current official cash rate is 4.35%.

My primary criticism is that when we look at the company’s cash holdings versus its burn rate, I believe Eden’s fees paid to its Board of Directors are far too high, both currently and historically. As an investor, it isn’t easy to justify FY23’s management salaries [excluding performance rights and share-based payments] at approximately AU$1,000,000. However, this is unfortunately common when looking at companies listed on the ASX.

Still, I strongly believe in the Solomon brother’s vision for Eden, and I also believe in their commitment to the company.

Expect to be Diluted

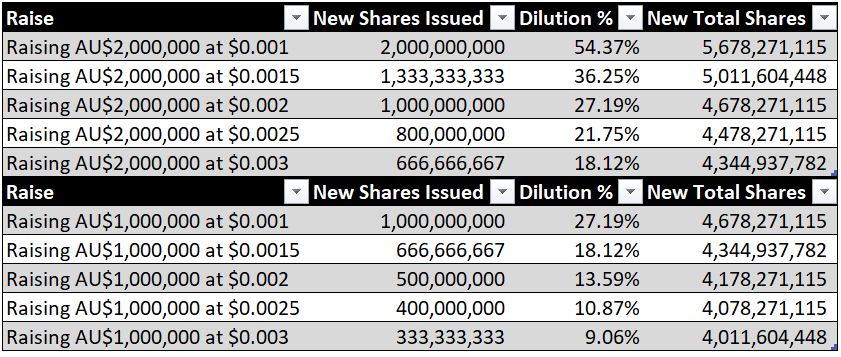

As I mentioned above, Eden is in an extremely tight spot cash wise. Therefore, while the share price is extremely depressed at the moment, I believe it’s likely investors will be subject to a capital raise within the next three to six months. Unfortunately, due to where the share price is currently, dilution could be as high as 54.37%, or as low as 9.06%.

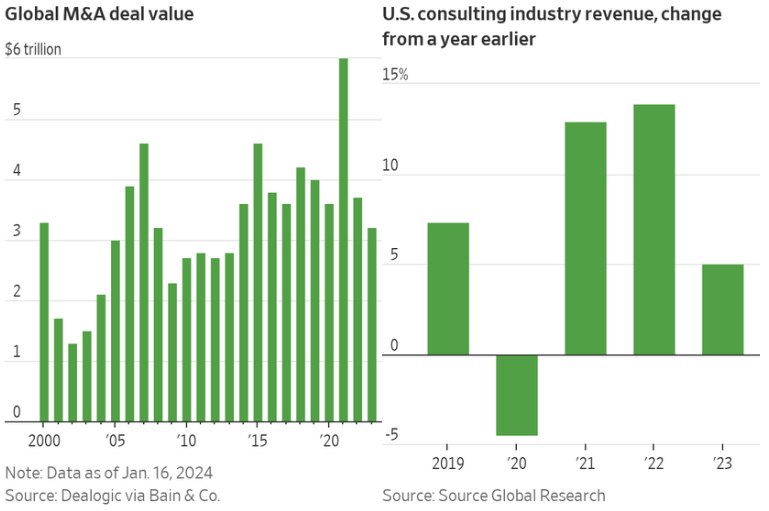

Following the recent joint venture announcement and the market’s overwhelmingly positive response, I no longer believe it’s likely Eden will be forced to raise capital below $00.002 per share. However, I unfortunately can’t rule it out in this difficult capital market, where capital is far tighter in Australia than in the U.S. at the moment.

It’s worth noting that a capital raise won’t be necessary if a significant order for EdenCrete® or EdenCrete Pz® comes through or if a major licensing deal for the Pyrolysis Project is signed. Another possibility is the sale of 65 acres of industrial land in Augusta, Georgia, U.S. While the sale of the land would provide much-needed working capital, it would also go a long way to paying down Eden’s debt. Eden has two potential buyers deciding if they should make an offer on the property, but it’s worth noting this has been the case since early in Q2 FY24.

Excluding the loan from Nobel Energy previously discussed, Eden has the following debt as of 31 December 2023:

- US$5,800,000 from iBorrow LP with an interest rate of 9.75% per annum | Secured by the Augusta property | Maturing August 7, 2024

- Eden’s U.S. division received a U.S. CARES Act SBA loan with US$26,929 outstanding.

However, I’m operating under the assumption that at least one more major dilution event is in the cards.

Eden is a Binary Investment Opportunity

As part of my portfolio I classify Eden as a binary investment. By this, I mean shares are currently trading right at the edge of the lowest possible price on the ASX. In other words, shares in Eden are trading at bankruptcy prices. In fact, before the 21 February 2024, joint venture announcement, the stock was regularly trading at AU$00.001 per share.

With a market capitalisation swinging between just over AU$4,000,000 [AU$00.001] and AU$11,030,000 [AU$00.003], I believe any commercially relevant order for EdenCrete® or EdenCrete Pz® would cause the price to move significantly higher. How much higher is entirely reliant on the size of any order and, therefore, would be pure speculation.

To summarise, my personal investment in Eden is a bet the company will achieve sufficient commercial adoption before cash runs out. But I’m not a gambler; I’m a long-term, fundamentals-based investor, and I believe Eden has more than proved its claims around EdenCrete® and EdenCrete Pz® are well founded. When I combine this with the significant pipeline of customers at the end stage of the decision to adopt the EdenCrete® and EdenCrete Pz® and the opportunities presented by OptiBlend® and the Pyrolysis Project, I decided an investment in Eden is a risk well worth taking. Please read the disclaimer at the bottom of the report, this report is only intended to explain why I have an investment in Eden Innovations.

My Position

I would usually leave disclosing my position to the disclaimers at the bottom of the report. However, due to Eden’s illiquid and less-than-a-penny nature, I wanted to disclose my position and involvement with the company before we go any further.

I have been an investor in Eden since 17 May 2021, initiating my position at AU$00.026 per share and sizing up all the way down. As it currently stands today, my average price per share is AU$00.0035. However, my largest purchase was not an on-market trade.

August 2023 Capital Raise

Following the success of my oil short [outlined here: OPEC+ Cuts Irrelevant: Oil Still A Short – 16 January 2023], I reviewed my holdings and realised Eden was the primary position I wanted to use the proceeds to size up. I also concluded that the company would need to raise capital soon and helped connect Peak Asset Management with Eden. [Disclaimer: I didn’t receive any form of compensation for making this connection, nor was I involved in the raise any further than the introduction, aside from investing in the raise myself.] When the placement was finally announced, I participated as one of the largest investors, taking 4.178% of the newly issued capital. The placement’s terms were AU$0.003 per share, with one option [one option equals one share in this case] for every two shares purchased with a strike price of AU$00.009 and an expiry of 11 September 2026. In total, the placement raised AU$1,100,000.

Disclaimer

I have a beneficial long position in the shares of EDE either through stock ownership, options, or other derivatives.

I wrote this report myself, and it expresses my own opinions. The purpose of this report is to explain why I have a specific stock in my personal portfolio. I am not receiving compensation for writing this report. I have no business relationship with any company whose stock is mentioned in this report.

While I express my opinion in this report explaining why a company is in my personal portfolio, only you can determine if a specific strategy is right for your portfolio. You should always do your own research before buying, selling, or shorting any stock. Any charts, graphs, or tables not specifically credited to another individual, company, or institution were created by the author using his own research.

Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Russell Katz is not a licensed securities dealer, broker or investment adviser or investment bank.