Tags

2024 Annual Threat Assessment, Africa, Australia, China, Consulting, Debt, Diamonds, EY, Finance, Foreign Policy, Gas Demand, Haiti, Haiti Crisis, India, Indo-Pacific, Japan, Lab Grown Diamonds, LNG, News, News Breakdown, News Summary, Private Equity, Russia, Tax Reform

In this segment, we summarise ten of the most important articles and reports from the work week you probably missed; 11 March 2024 through 17 March 2024. In no particular order:

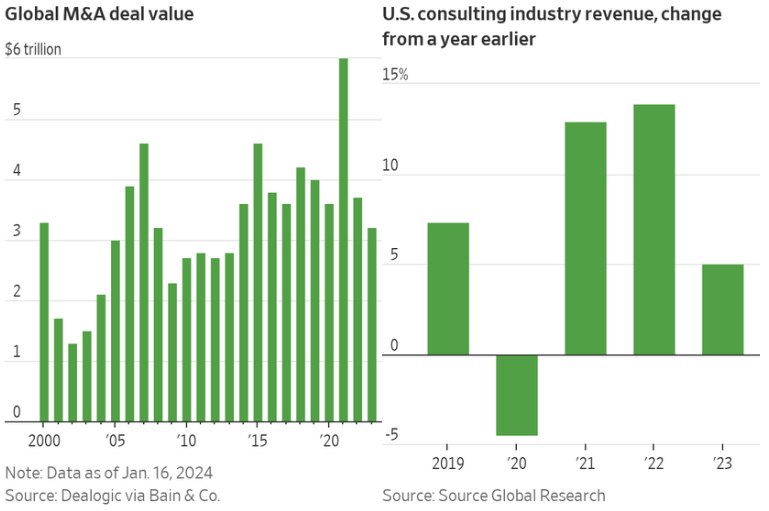

1. Consultants Are Paid to Fix Businesses. Why Can’t They Fix Their Own? – Wall Street Journal (16 March 2024):

Global consulting firms squandered the double-digit growth they received during the COVID-19 pandemic and are now forced to slash staff. What makes these rounds of layoffs so significant is that partners are on the chopping block, as well as general staff, with EY laying off 100 U.S. consulting partners. While a number of factors are contributing to the slowdown, a sharp slowdown in private equity deals combined with a focus on large corporations on cost cuts has reduced U.S. consulting revenue growth forecasts to 6%. Far below what the industry needs to keep its hiring and promotion track.

2. Japan’s declining gas demand will leave utilities with persistent LNG oversupply through 2030 – Institute for Energy Economics and Financial Analysis (11 March 2024)

As electricity generation from renewables and nuclear energy rises, Japan’s largest utilities are forced to deal with a liquified natural gas (LNG) glut of 11,000,000 tonnes per annum. With little to no easy demand growth opportunities in the domestic gas market, the utilities are shifting to exporting the excess, focusing on South and Southeast Asian markets. However, due to the strength of the oversupply, Japanese utilities are often forced to sell the LNG at a loss.

3. The Temptation of Frontier Markets – Project Syndicate (12 March 2024)

Barry Eichengreen, Professor of Economics and Political Science at the University of California, Berkeley, and a former senior policy adviser at the International Monetary Fund, says several African countries have returned to investors’ sights following the strong macroeconomic performance. Between January and early February, Cote d’Ivoire placed US$3,350,000,000 in bonds with investors at 3x and 6x oversubscription rates, respectively. Kenya issued €1,500,000,000 in debt, which was ~3x oversubscribed. But he warns of two key dangers investors need to be prepared for:

- The first risk revolves around one of the key ways investors are betting on these countries: foreign-currency bonds. While well-known, these risks seem to frequently catch investors unprepared, and if investors are incorrect in thinking that inflation is over, the ability of countries to pay back bonds not in their own, often depressed currency, will come into question.

- The second risk is the failure of a debt scheme for developing countries to come into effect; as Professor Eichengreen notes, developing debt markets are highly contagious.

4. For Global Tax Reform, the Devil Is in the Details – Project Syndicate (12 March 2024)

Jayati Ghosh, Professor of Economics at the University of Massachusetts Amherst, a member of the Club of Rome’s Transformational Economics Commission and Co-Chair of the Independent Commission for the Reform of International Corporate Taxation outlines the two different proposals for subject-to-tax rules. It’s important to note she is a proponent of the United Nation’s version over the Organization for Economic Cooperation and Development (OECD).

5. The Dawn of India’s Semiconductor Era – The Diplomat (15 March 2024)

In 2021, India released the India Semiconductor Mission, which coincided with strong subsidies and support for major industrial players to enter the semiconductor space domestically. As part of its strategy, the country is focused on the entire process, from research and development to fabless chipmaking, design, fabrication, and equipment supply. Part of India’s pitch is its relative political stability compared to other nations in the region and its distance from China following what many see to be a splitting of globalisation. The strategy has shown signs of working, with Micron establishing an assembly facility in Sanand, Gujarat for NAND and DRAM chips, with plans to manufacture “Made in India” memory chips by the end of 2024.

6. Why Russia Will Keep Supporting China in the Indo-Pacific – The Diplomat (16 March 2024)

Russia’s foreign policy has become more closely aligned with China’s as of late. One example is in the Indo-Pacific, with Russian-Chinese joint military maneuvers increasing in frequency and size. Russia has also recently stated it will oppose Taiwan’s independence in any form, has increased its verbal attacks on the Quad, and has become more vocal in its public backing of Chinese policy. The Diplomat’s analysis points to Moscow’s goals replacing the current Western-led world order with a multi-polar, regional one. The Diplomat believes Russia views the U.S.-led global order as its main threat and views China and Iran as vital, long-term allies.

7. 2024 Annual Threat Assessment of the U.S. Intelligence Community – U.S. Office of the Director of National Intelligence (11 March 2024)

Despite the report being dated 5 February 2024, the Annual Threat Assessment of the U.S. Intelligence Community by the U.S. Office of the Director of National Intelligence was publically made available only last week on 11 March 2024. While you may be thinking, why must I review this report? I’m only interested in what affects the markets. The report “reflects the collective insights of the Intelligence Community, which is committed every day to providing the nuanced, independent, and unvarnished intelligence that policymakers, warfighters, and domestic law enforcement personnel need to protect American lives and America’s interests anywhere in the world.” In other words, this report is a collection of the largest macro and micro risks that could affect your portfolio over the coming year. I strongly recommend reading this report. This year it covered:

- STATE ACTORS

- China

- Russia

- Iran

- North Korea

- Conflicts and Fragility

- Gaza Conflict

- Potential Interstate Conflict

- Potential Intrastate Turmoil

- TRANSNATIONAL ISSUES

- Contested Spaces

- Disruptive Technology

- Digital Authoritarianism and Transnational Repression

- WMD

- Shared Domains

- Environmental Change and Extreme Weather

- Health Security

- Migration

- Non-State Actor Issues

- Transnational Organized Crime

- Human Trafficking

- Global Terrorism

- Private Military and Security Companies

- Contested Spaces

8. Gen Z doesn’t care where diamonds are from – even if it’s a lab – Australian Financial Review (15 March 2024)

The French government issued an edict that all lab-grown diamonds solid in France must be labelled “synthetic.” Despite this, the younger generation cares less that a diamond is lab-grown, especially when they are “chemically, physically and visually the same.” Lab-grown diamonds are typically 50% cheaper than natural counterparts, but despite the pros, major diamond companies continue to focus their sales on mined diamonds, and their marketing on lab-grown diamonds being “cheap” and “fake.” Although there are some signs this is changing, with LVMH brands having lab grown diamonds appear in some of their designs.

9. Embattled Haiti Prime Minister Ariel Henry to resign under U.S. pressure over crisis – Miami Herald (12 March 2024)

The, now former, Prime Minister of Haiti Ariel Henry has finally resigned in yet another win for the Haitian gangs who control most of the country. For quite a while now the gangs have been threating civil war and physically blocking the former Prime Minister from returning to Haiti. A seven-member presidential council has been formed to pick a new Prime Minister with support from the United States other Carabian nations. Negotiations continue, but no outcome is clear.

10. Australia, China prepare for high-level talks in strategic dialogue – Defence Connect (15 March 2024)

Defence Connect reports the Chinese Director of the Office of the Central Commission for Foreign Affairs, PRC Minister Wang Yi, also a CPC Central Committee Political Bureau member, will travel to Australia and New Zealand between 17 March 2024 and 21 March 2024 as part of an official visit to both countries. The visit is a vital step towards normalising relations between Australia and China, with PRC Foreign Ministry spokesperson Wang Wenbin stating the visit is likely to start high-level exchanges.