As usual a great article from my friend over at howtostuffyourpig.com.

Credit Cards: Ending the Debt Cycle

15 Tuesday Sep 2015

Posted in Uncategorized

15 Tuesday Sep 2015

Posted in Uncategorized

As usual a great article from my friend over at howtostuffyourpig.com.

04 Friday Sep 2015

Posted in Uncategorized

Tags

I am back from vacation and will be living in Australia for a while. There will be a new blog post tonight so stay tuned.

21 Friday Aug 2015

Posted in News Breakdown

20 Thursday Aug 2015

Posted in Uncategorized

I will be in Europe from 8/20/2015 through 9/3/2015. I will try and keep up with the Daily News Breakdown however, I cannot promise there will be one everyday during this time period. They will continue after I return.

Thanks Loyal Readers,

The Financier Daily

20 Thursday Aug 2015

Posted in News Breakdown

Tags

DMZ, Finance, Greece, Korea, News, North Korea, South Korea

Greece’s Prime Minister, Alexis Tsipras, announced today that on Thursday he would resign. This is a move that should cause concern among European Leaders as the future of the recently agreed upon bailout once again becomes shaky.

Tensions have mounted on both sides of the demilitarized zone as North Korea fired a rocket at South Korea prompting them to fire back with an artillery barrage. Today North Korea threatened to “start a military action” unless South Korea ceases all propaganda broadcasts and removes their loudspeakers within 24 hours; something South Korea is not likely to do.

19 Wednesday Aug 2015

Posted in Uncategorized

Great article worth a read!

19 Wednesday Aug 2015

Posted in News Breakdown

Daily Market Update

Oil ended the day at a six year low due to a surprise increase in United States crude stockpiles. The Energy Information Administration announced that crude supplies rose 2.62 million barrels last week compared to analyst estimates of a 820,000 barrel decline.

Greece will receive the first installment in its new bailout package of 13 billion euros on Thursday as well as 10 billion euros set aside for the banks. The deal was finalized Wednesday as lawmakers in Germany and the Netherlands gave their approval. For more information click here

The Federal Reserve meeting minutes showed that the Fed believes it is not time to raise rates. The minutes said that the Fed would like to see greater improvement in the jobs market before they increase rates but that the job market is almost ready. For more information click here

19 Wednesday Aug 2015

Posted in Commentary

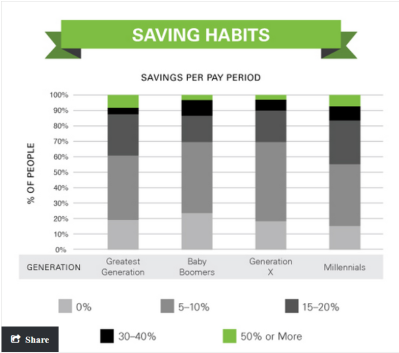

On August 9, 2015 an article was published on marketwatch.com titled: “Millennials are saving — but they’re doing it wrong” the article discussed how the generation that grew up during the crash of September 2008, also known as the Great Recession, are saving at a rate higher than any other generation.

Source: http://www.marketwatch.com/story/millennials-are-saving-but-theyre-doing-it-wrong-2015-08-07

According to a study by bankrate.com and cited by MarketWatch, 26% of Americans under 30 are invested in stocks. The 74% of Americans who are not investing their money and earning a maximum of 1% on their savings accounts are actually losing money when you factor in an average inflation rate of 1.6% in 2014. Meanwhile if invested in the Vanguard 500 Index Fund, which owns the 500 largest companies listed on the US stock exchange, than you would have made a return of 14% in 2014. After fees of 0.17% and inflation of 1.6% you would have earned a profit of 12.33% on your investment instead of losing 0.6% due to inflation on a savings account. An example is:

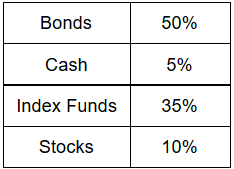

An important point to remember when deciding how to save for retirement or even just save in general is there is no such thing as all or nothing in investing. The term for this is asset allocation and in layman’s terms means how you organize your portfolio. An example is:

As you can see from the allocation above investing is not an all or nothing strategy. Index Funds follow certain parameters for their allocation which can be anything from a sector of the market to the S&P 500. Stocks are individual companies and therefore, less diversified. Bonds are debt and I recommend not owning any bonds with a credit rating less than A- bonds can also be insured which helps limit your total amount of risk. Another important point to consider is why is this money being saved. Your retirement account should have less risk than the rest of your investments and your allocation should reflect that. Remember there is no one size fits all investment strategy and you as an adult need to take the time to create your own personal asset allocation strategy.

As you can see from the allocation above investing is not an all or nothing strategy. Index Funds follow certain parameters for their allocation which can be anything from a sector of the market to the S&P 500. Stocks are individual companies and therefore, less diversified. Bonds are debt and I recommend not owning any bonds with a credit rating less than A- bonds can also be insured which helps limit your total amount of risk. Another important point to consider is why is this money being saved. Your retirement account should have less risk than the rest of your investments and your allocation should reflect that. Remember there is no one size fits all investment strategy and you as an adult need to take the time to create your own personal asset allocation strategy.

What about people who do not have time to research each individual stock? My recommendation is an Index Fund. Index Funds have a great resource, morningstar.com an example of which can be found here. With investing it is important to remember to have a long term outlook. When I invest I look forward ten years into the future and ask myself will I be glad I owned this and why. Vanguard and Fidelity have great low cost Index Funds. When purchasing an Index Fund, unlike a stock, you are purchasing a basket of stocks with a general theme. That theme can be anything from mirroring the S&P 500 to clean water. My personal recommendation is to start out with Vanguard 500 Index, found in the example above, and expand from there.

When I was 12 years old I taught myself to read a quarterly and annual SEC filing. I did it through reading the reports and looking up terms and phrases on sites like Investopedia.com and sometimes Wikipedia.com. I took a half an hour out of my day to read articles on the BBC, CNBC, and Bloomberg. Reading daily news helps you understand the connections of our daily world. My blog provides a daily news breakdown Monday through Friday.

-Websites

-Blogs

18 Tuesday Aug 2015

Posted in News Breakdown

As soon as next week Iran plans to sign a contract with Russia for four S-300 Surface-to-air systems. In the emerging cold war between the West on one side and Russia and China on the other; this sale is clearly an attempt by Russia to gain a political ally in the Middle East as Iran continues to gain a dominate political foothold in the region.

In a test vote by German Chancellor Merkel results showed a majority in favor of the current bailout proposal.

In a move certainly to irritate Saudi Arabia a collation of Arab religious leaders have called on oil rich Arab countries to stop oil production and to move 100% to renewable energy by 2050. The declaration has already received support from the Grand Muftis of Uganda and Lebanon. Along side the recent G-7 declaration this is further proof of the coming end of oil dominance in favor of renewable energy.

15 Saturday Aug 2015

Posted in Commentary

The International Monetary Fund has welcomed China’s devaluation of the Yuan due to their economic need for more exports. On August 11, 2015 the People’s Bank of China announced the move from a tightly controlled currency to one more controlled by market forces. The IMF has reiterated the need for China to move towards a more market based currency before China’s recent devaluation in a report published on July 7, 2015 they stated that a free-floating currency is

necessary for allowing the market to play a more decisive role in the economy, rebalancing toward consumption, and maintaining an independent monetary policy as the capital account opens

China recent move towards a more market based currency is clearly an attempt by the country’s government to boost exports after July’s export numbers tumbled 8.3%. When looking at numbers coming out of China, like July’s export statistics, it is important to remember that they are impossible to verify and are commonly believed the be at least a little manipulated. After the massive monetary policy shift from the People’s Bank of China one should assume that China’s economy is likely in worse shape than they are currently letting on.

Recently China’s economy became the biggest in the world and with these troubling numbers coming out of China investors should watch them like a hawk.

For more information on the IMF click here